Spring symbolises rebirth and renewal, growth and new beginnings, and this month’s uptick in spending is surely the newness and growth we all long for.

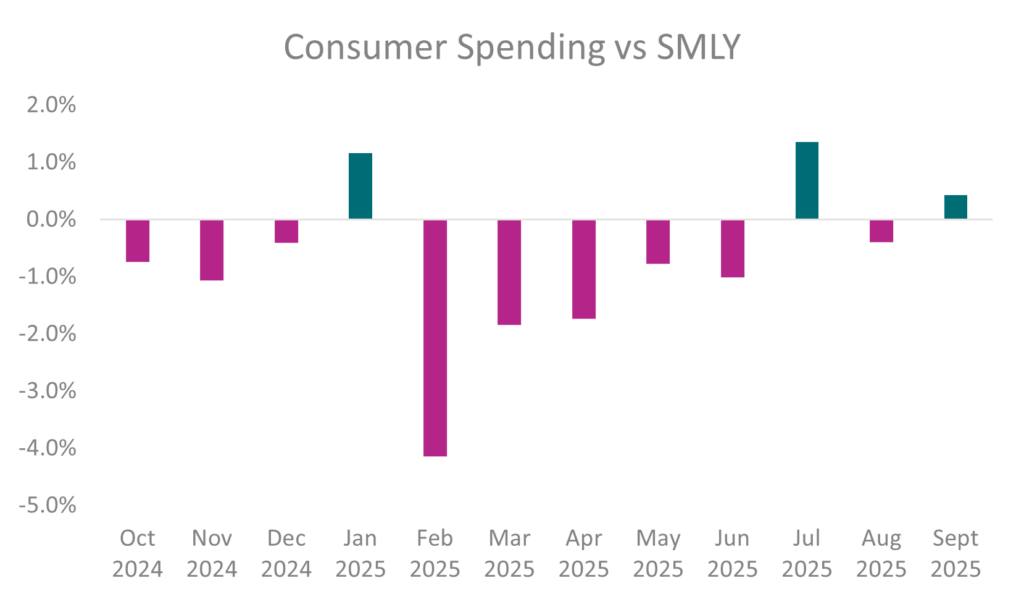

Spend was up a meagre +0.4% on September last year.

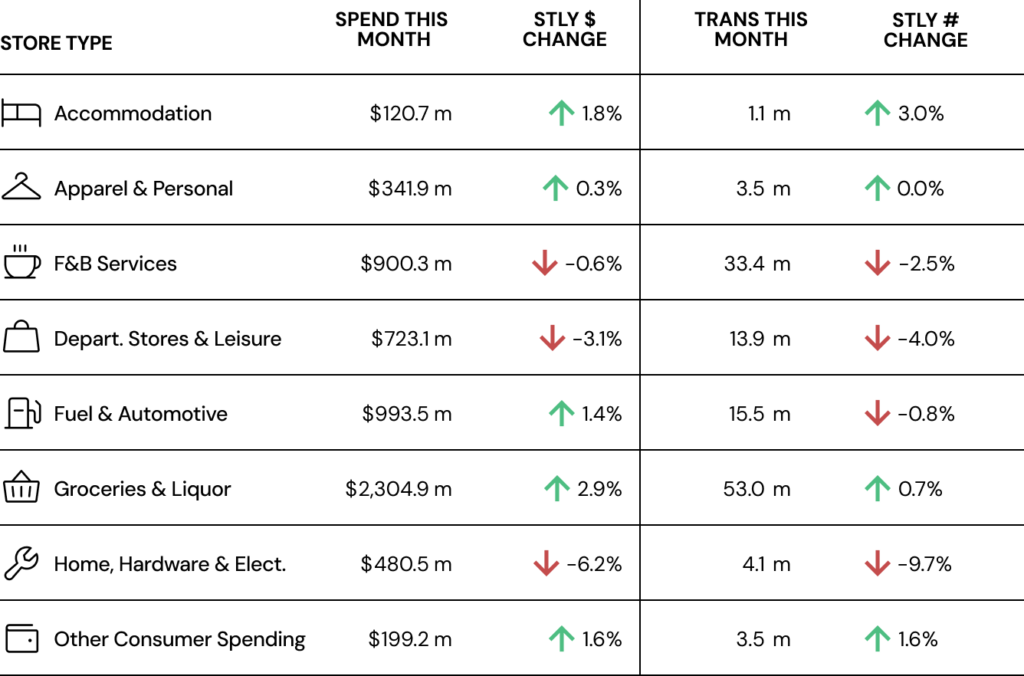

It was primarily driven by Essentials (groceries & fuel) and Tourism-related storetypes (accommodation and other) which rose +2.5% and +1.6% respectively.

In contrast, non-essential spending (apparel, department stores, leisure, and home) and hospitality (Cafes, Restaurants, Bars & Takeaways) dropped -3.4% and -0.6% respectively.

Internationals continue to drive spend this month (+19.0%), with Americans leading the charge, up +33.6%, followed by the British, up 15.0%.

Key insights for September 2025

- Consumer spending grew by +0.4% this month when compared to September 2024, while transactions dropped by -1.2%. That transactions still shows an oppositive trend to spend indicates consumers are still trying to reduce how often they spend money.

- Sadly, essentials are still where the growth in spend lies (up +2.5%), with spend on non-essentials and hospitality down -3.4% and -0.6% respectively.

- International visitors continue to spend more than the same time last year, this September up 19.0%. It’s driven by the Americans and Brits who increased spend +33.6% and +15.0% respectively.

- A storetype breakdown is detailed in the table below:

Breaking the shackles of winter?

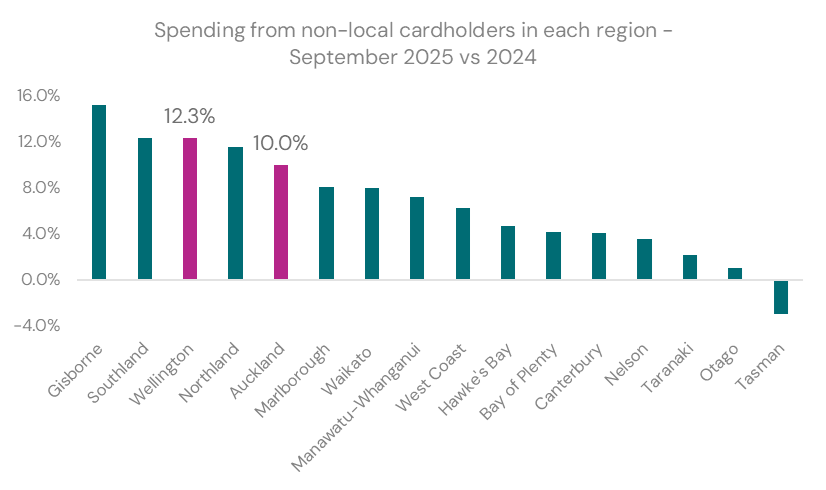

This month, we saw a 6.9% increase in non-local spending (i.e. spending outside of one’s home city/district). With September marking slightly warmer temperatures, and the final school holidays of the year, it looks like many of us took the time to get away from our usual surroundings.

This spend injection, by both New Zealand non-local and International cardholders was shared generously across the motu, with the exception of Tasman, as illustrated below.

What stood out were the main urban regions of Wellington and Auckland. They have had it tough for a very long time. Reading of yet another esteemed hospitality establishment or retail store closing outlets or going belly up was with such regularity that it no longer invoked the same shock it once used to. That it has generated double-digit spend increases from non-locals is encouraging for the upcoming peak tourism season ahead.

Wellington’s 12.3% increase was derived from by all storetypes. Spend from Food Retailing and Cultural and Recreational Services were especially impressive, up 19.7% and 19.0% respectively. This was followed by F&B Services (up 11.7%) and Fuel Retailing (up 11.6%).

Auckland’s 10.0% increase was derived from almost all storetypes. Sadly, Accommodation was the exception. Like Wellington, Food Retailing and Cultural and Recreational Services were the highest for Auckland, up 16.3% and 15.2% respectively. Spend on Other Retailing was next highest (up 10.4%) followed by F&B Services (up 9.3%).

Despite the positive results above, once you include local spending Wellington Region is down 0.1% and Auckland is up a marginal 0.25% only. All the downbuzz that we read in the media is primarily driven from by spending. Local spending makes up 80%+ in both regions, and in our suppressed economy, overwhelms even the best of non-local spending down to create an overall net negative effect.

With Black Friday on the horizon, it will be interesting to see if kiwis are holding back in October in preparation for a big splurge in November.