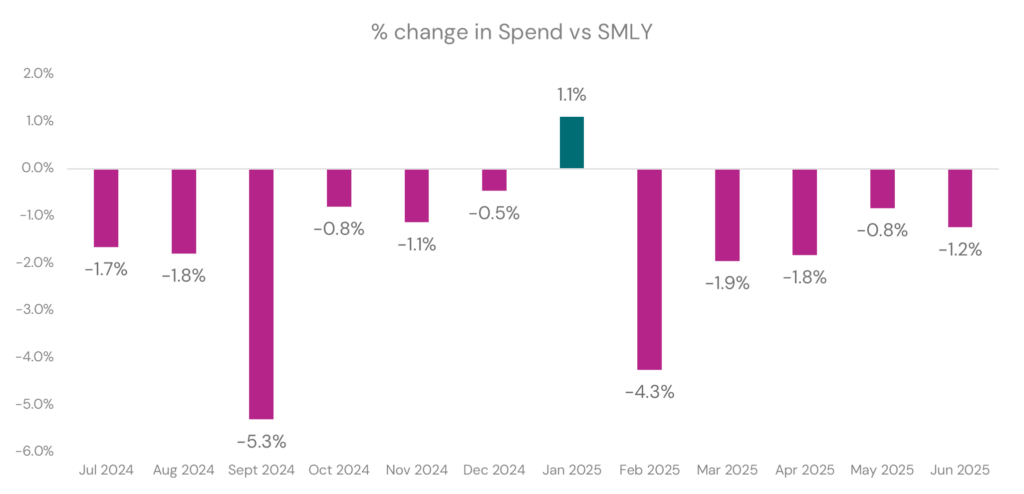

Midway through 2025 and the ‘Make it to 2025’ mantra every struggling retailer chanted in late 2024 still bears no merit. Spend in June 2025 was down on last year, continuing the trend we have seen for most of the year (see chart below). Over the last 12 months, spending is -1.6% over the previous year.

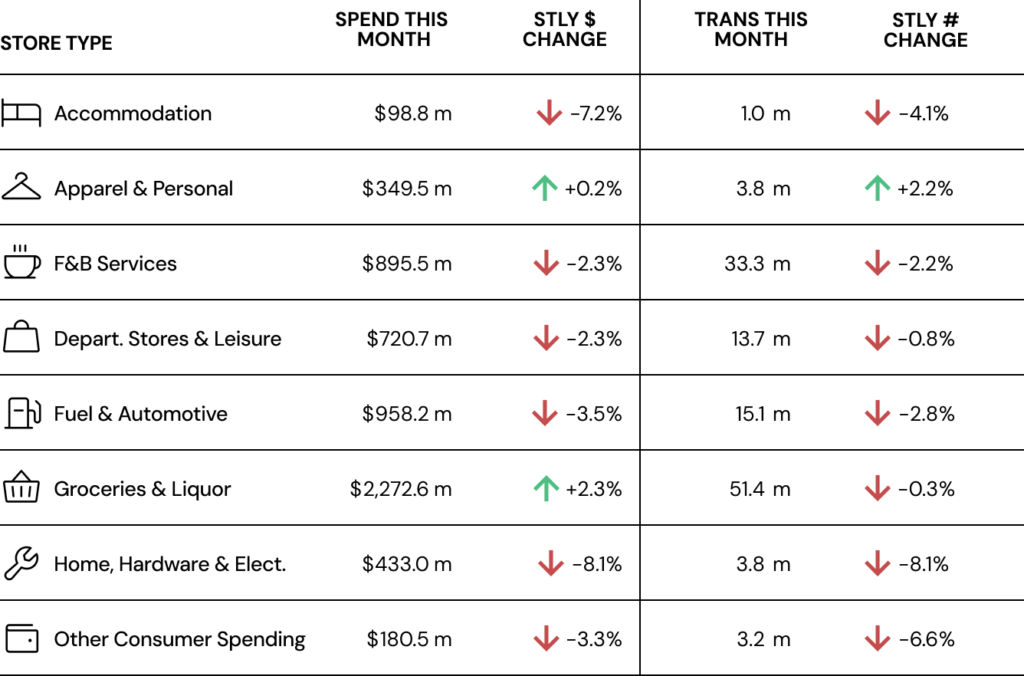

This June, Groceries & Liquor continues to record a spend increase, up +2.3%, while the volume of transaction drops -0.3%. This dynamic likely reflects the increase in food prices (see further details below).

Apparel & Personal was only other storetype that saw an increase in spend (up +0.2%) and a surprise one at that, given the restraint on ‘nice to haves’ when we are already struggling to afford the ‘must haves’ at present.

Key insights for June 2025

- Consumer spending dropped -1.2% this month when compared to June 2024, while transactions dropped -1.5%.

- International visitors continue to spend more than the same time last year, this June up +16.3%.

- Closer to home, Tasman cardholders spent the most, up +9.3%, potentially as they try and rebuild what has been damaged and lost through the floods.

- Groceries & Liquor maintained their growth at 2.3% increase in spend this month.

- Was also encouraging to see Apparel & Personal enjoying an increase in spend, albeit a small one at +0.2%.

- A storetype breakdown is detailed in the table below:

The Opportunity Cost of Increased Food Costs

Groceries & Liquor is a storetype that has seen consistent growth amidst our cost-of-living crisis. Spend rose in 9 of the last 12 months when compared to the previous 12 months (see chart below), more than any other storetypes.

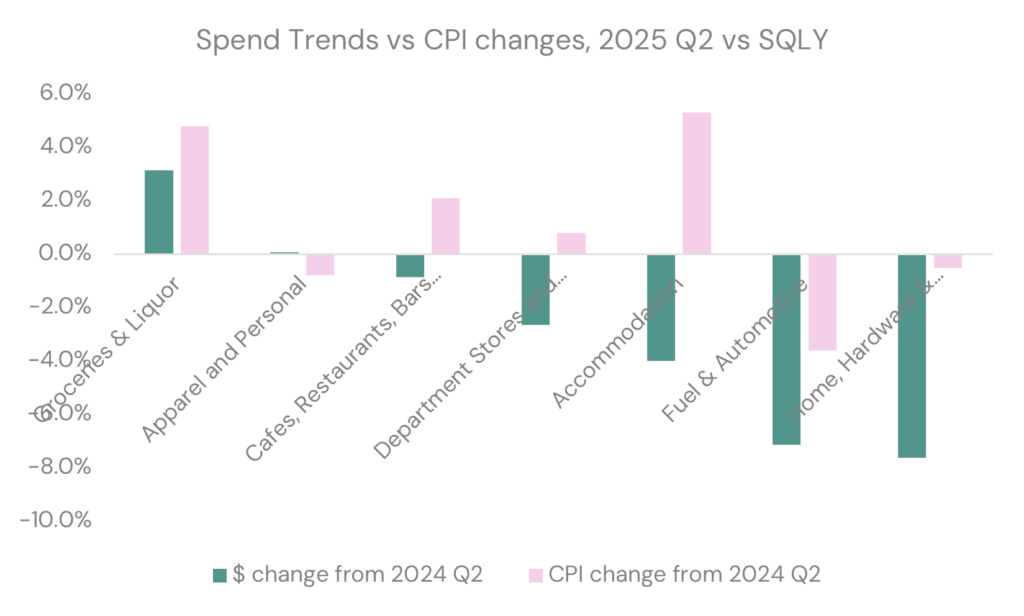

We don’t need to be told that things are more expensive nowadays because we see it in the supermarkets with the price of butter, and also feel it in our wallets. How many of us are choosing to buy home brands now or are buying based on the price per 100g? It was sobering to hear Stats New Zealand quantify that butter was up 46.5% annually! Overall, food costs in the June quarter have increased by 4.2% which suggests that spending levels are increasing due to inflationary pressures rather than by desire.

The flip side is that while prices across other industries are largely stable, we have less cash available for these. In the chart below we compare spending trends against price increases (sourced from Stats NZ CPI).

The government is attempting to curb inflation and increase supermarket competition. However, any fruits from that labour will not be felt in the short term. For now, we remain careful of what we throw into our trolleys, still wince and carry on.