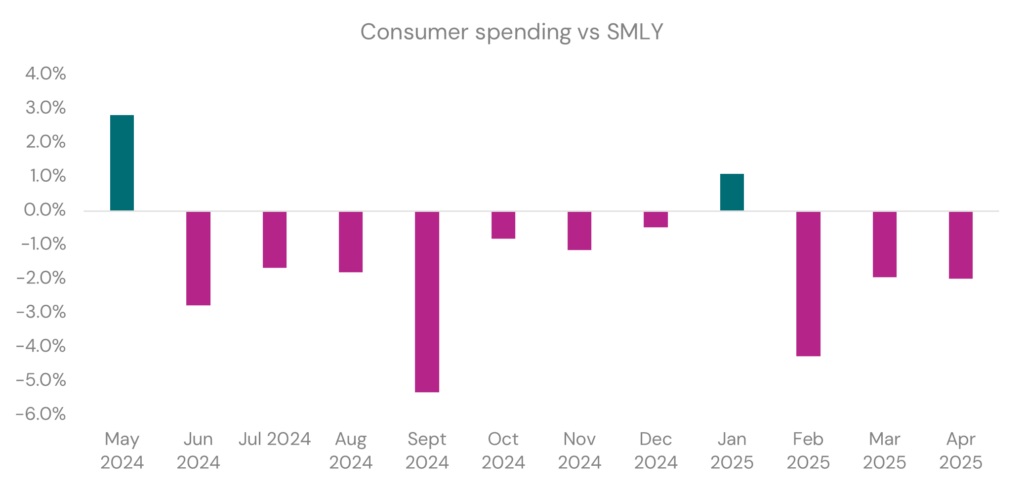

April 2025 continues to see a decline in consumer spending, down -2.0% when compared to the same month last year (SMLY). Of the last 12 months, only May 2024 and January 2025 saw spend increase (see chart below). This is supported by Tony Alexander’s business survey findings, who commented that many businesses are feeling that the economy is weaker than expected.

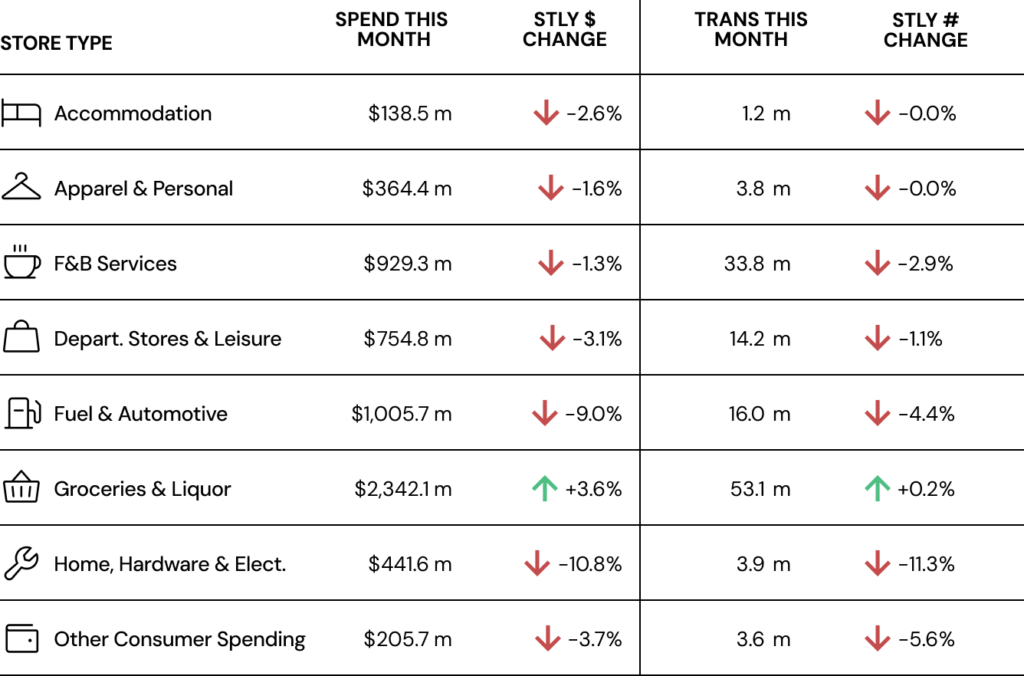

Groceries & Liquor is the only storetype that saw spend increase (+3.6%). One wonders if the inflationary price of butter is single-handedly responsible for this growth!

International visitors continue to prop consumer spending up, with spend up +16.6% this month. In contrast, domestic consumers dropped their spending by 2.9%. The public holidays might have played a part here, as we look further into it below.

Key insights for April 2025

- Consumer spending dropped -2.0% this month when compared to April 2024, and Transactions dropped a similar amount, down -1.9%.

- Groceries & Liquor was the only storetype that saw spend increase, up +3.6%. Transactions only rose 0.2%, which suggests that either prices of goods have increased from last year and/or people are purchasing more premium brands (the former being the likely driver).

- The Otago Region was one of five regions that enjoyed an increase in spend this month, up +2.6%.

- A storetype breakdown is detailed in the table below:

Flocking to the Regions

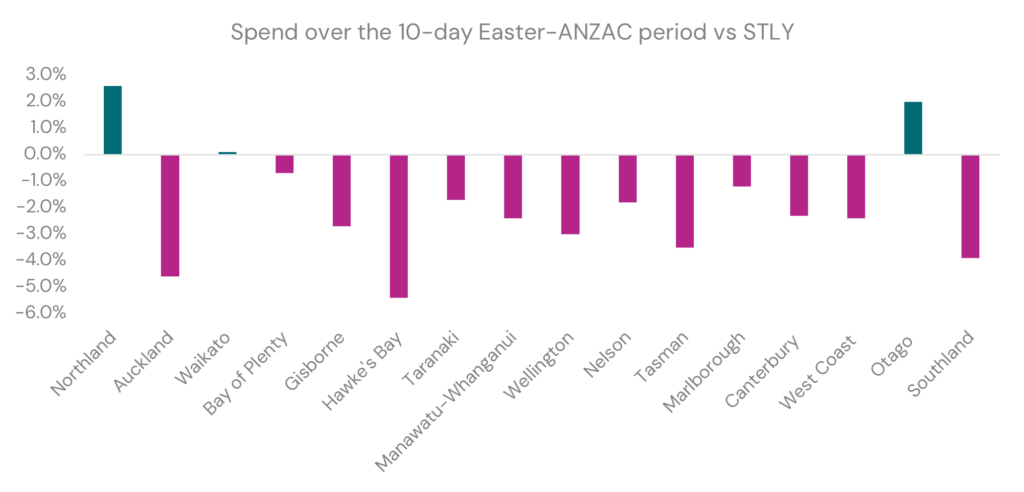

With Easter and ANZAC Day closely bunched together this year, gave people the chance to take an extended break (10 days with only 3 days of annual leave). It looks like many of us took this opportunity to engage in some R&R rather than retail therapy. Nationally, spending was down -2.5% compared to last year.

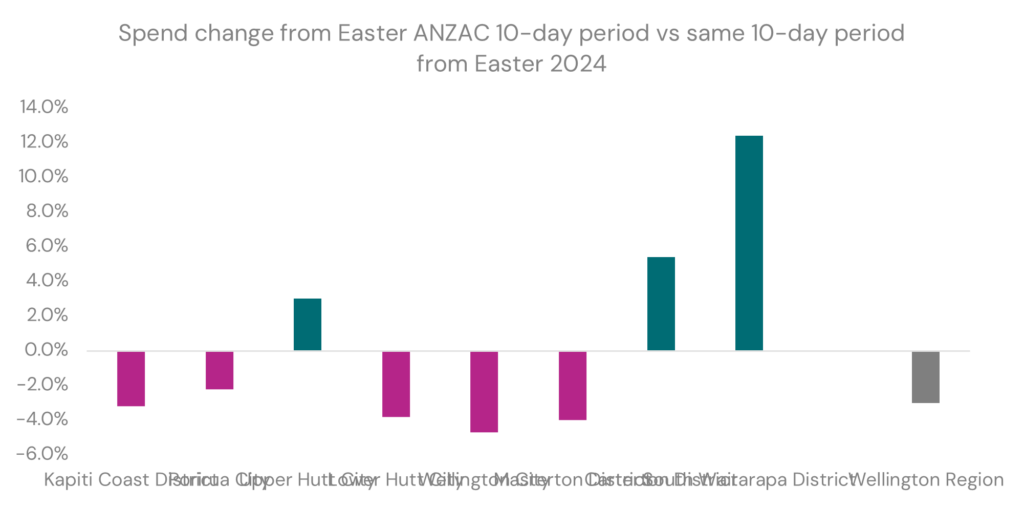

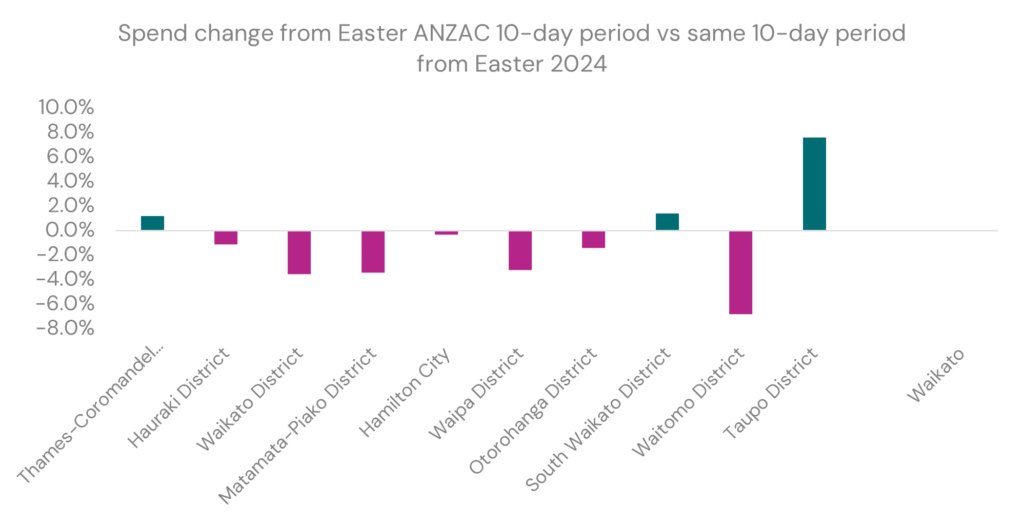

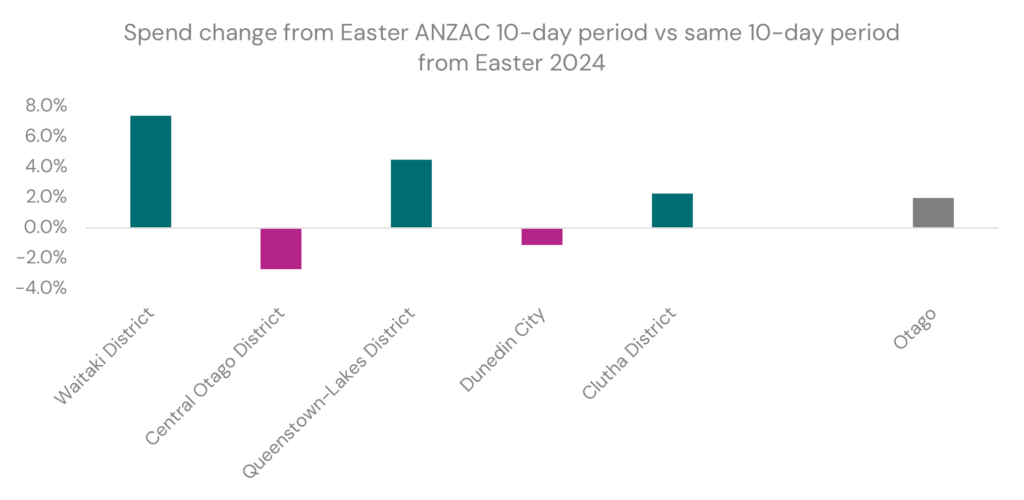

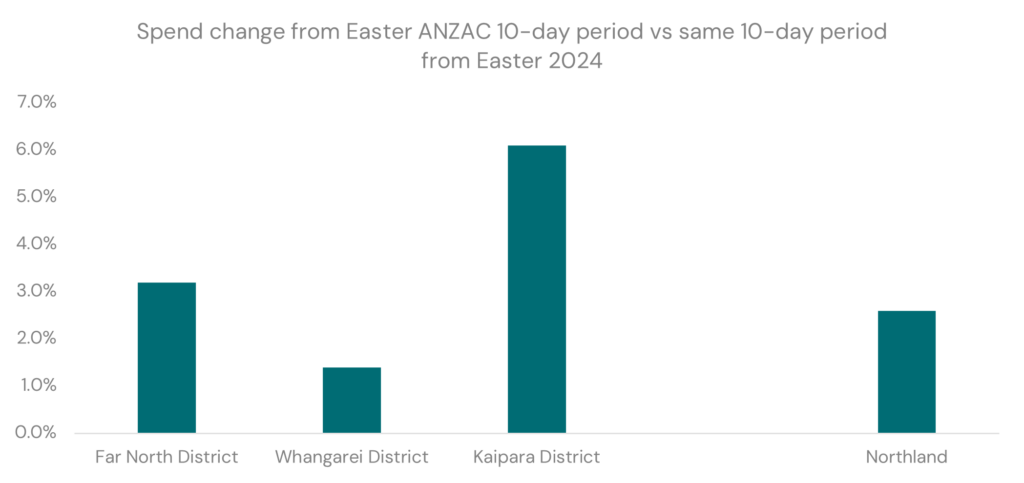

Only three regions experienced growth over this period, as shown below.

Despite the overall down trends, we’ve noticed some winners within the regions, most notably the traditional holiday destination areas.

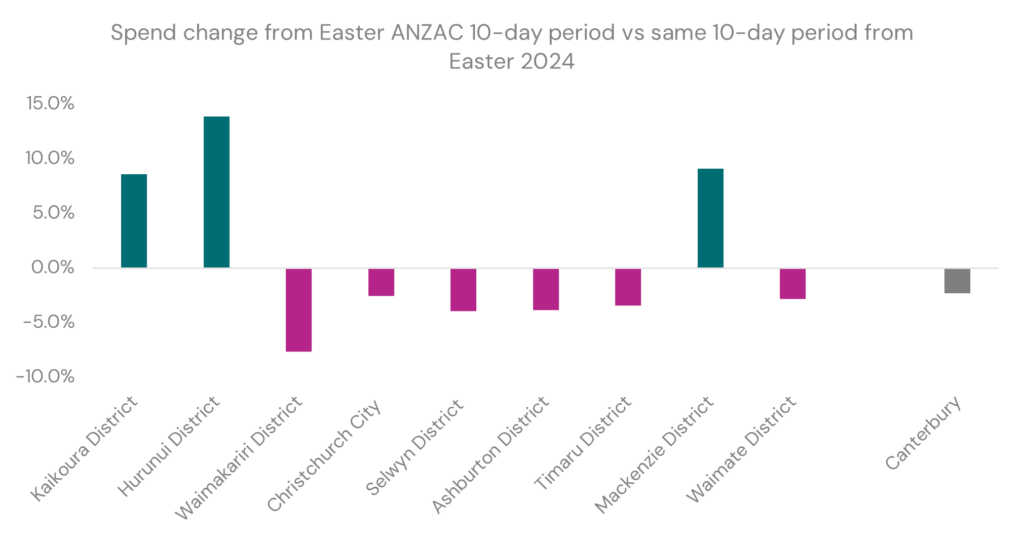

In the Canterbury region, spend dropped -2.3%, but the resort town of Hurunui was up +13.9%, beautiful Mackenzie was up +9.1%, and Kaikoura rose +8.6%. Meanwhile, Christchurch City saw spend drop -2.5%.

In the Wellington Region, spend dropped -3.0% but the likes of South Wairarapa was up +12.4%. I’m envisaging many were enjoying getaways to boutique Martinborough amidst the vines and their delicious pinot noirs. Wellington City saw spend drop by -4.7%.

Waikato as a region saw spend increase marginally by 0.1% but Taupo went gangbusters at +7.6%. Not only do people have holiday baches in Taupo, but they’re also well known as a great family holiday destination.

In the Otago Region, spend was up +2.0% for this 10-day period, and it was driven by Waitaki District, up +7.4%. It’s a destination I would like to visit soon too, with their Oamaru penguins, historical precinct and Steampunk HQ.

All of Northland’s districts saw spend rise, highest of which was Kaipara District, up +6.1%. Might this be a belated visit to the Tane Mahuta which re-opened in December 2024?

It looks like many of us used this period to take some time away from our usual environment. While this didn’t have an overall positive impact on retail, there were some winners in some of our popular holiday destinations.