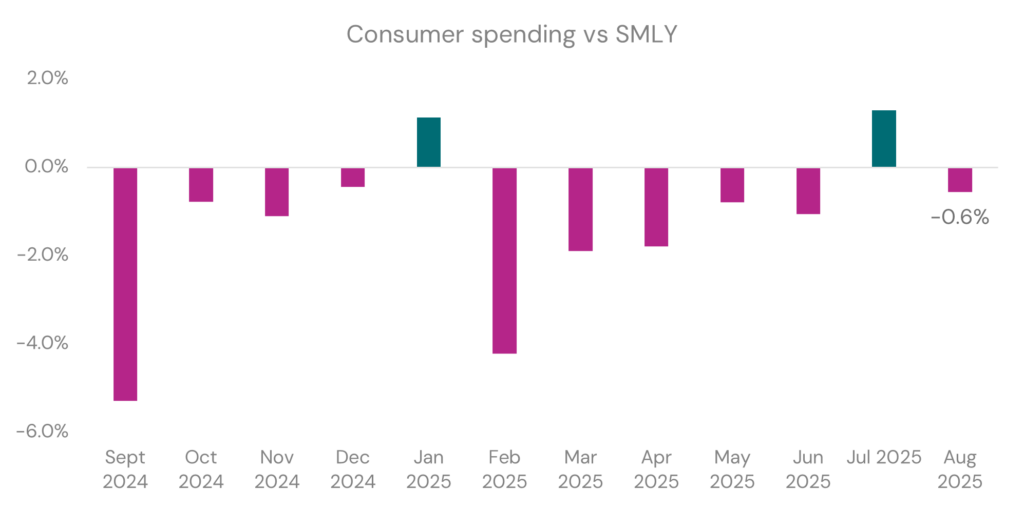

It was simply too good to be true. August 2025 failed to sustain the growth felt in July, with a drop of -0.6% from August last year. This comes on the back of Stats NZ reporting a drop of -0.9% in our GDP for the June quarter of 2025.

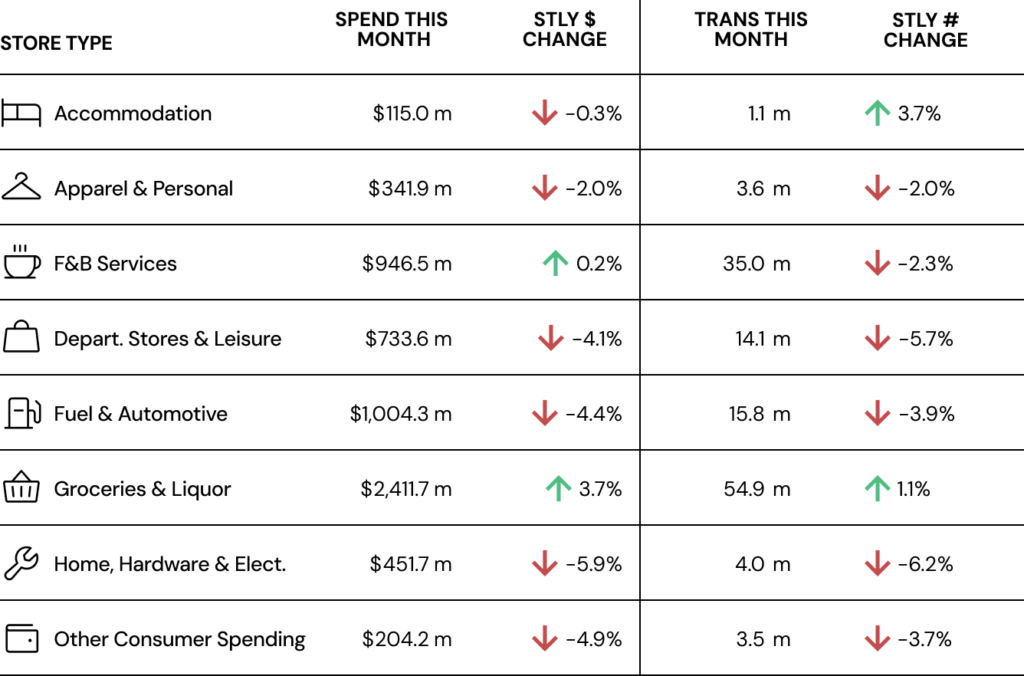

Groceries & Liquor continue to lead the growth, shamelessly enjoying a growth of +3.7% this month; with Cafes, Restaurants, Bars and Takeaways the only other storetype to enjoy a growth in spend, up +0.2% from the same month last year.

International visitors continue to attempt to counter the drop in New Zealand spend (-1.3%). But at 5% share of total spend, even increasing spend by +16.4% hasn’t helped the net result for August.

Key insights for August 2025

- Consumer spending dropped by -0.6% this month when compared to August 2024, while transactions dropped even more, down -1.6%. This reflects a desire to spend less by transacting less, but the inflationary conditions make it hard to achieve.

- International visitors continue to spend more than the same time last year, this August up 16.4%. Interestingly, Internationals’ transactions grew by more than their spend (+23.0%), indicating they too are making smaller value transactions.

- Closer to home, Tasman cardholders continue to spend the most, up +9.3%.

- Groceries & Liquor enjoyed another spend hike of +3.7% this month, where transactions only grew 1.1%.

- A storetype breakdown is detailed in the table below:

A Deep Dive into that Tale of Two Cities – ABs vs Springboks

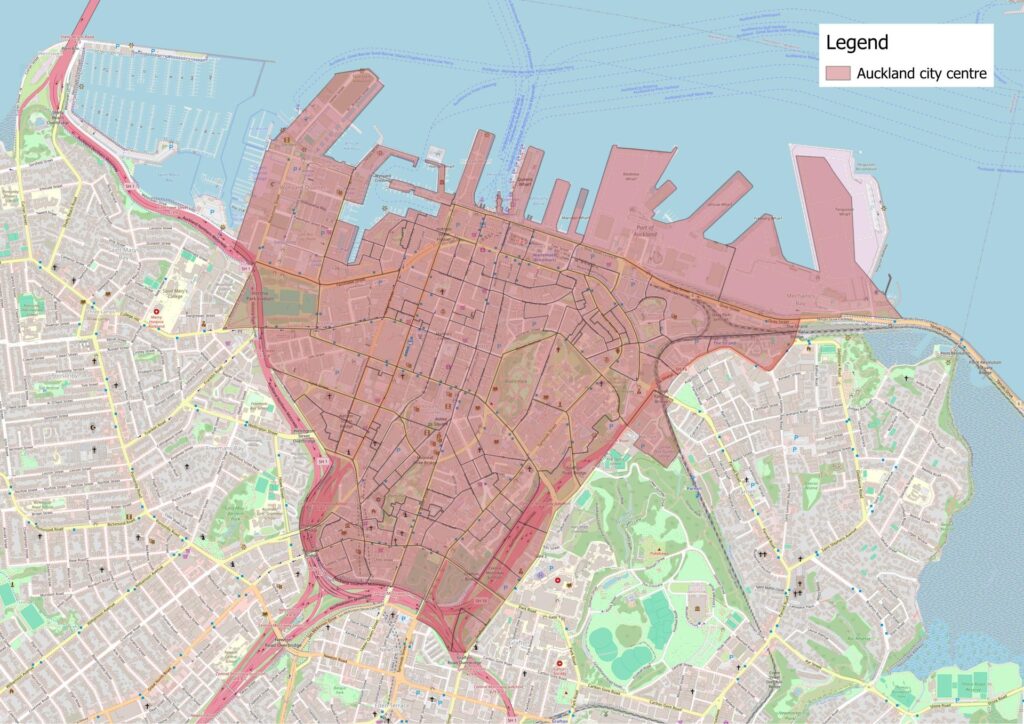

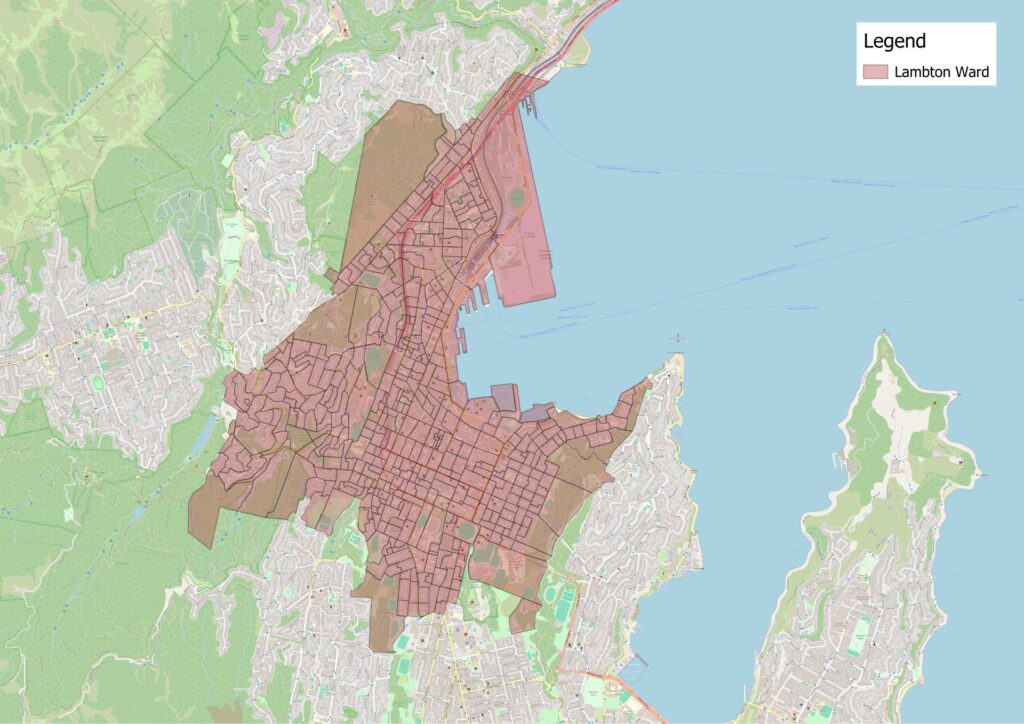

Auckland and Wellington each had the opportunity to host the All Blacks test against the Springboks. A few weeks ago, we’d reported that it was a Tale of Two Cities as both hosted the same two teams and yet the retail impacts were a vast difference. Auckland had a meh result of 0.5% increase in spend in the city centre, while Wellington enjoyed a significant 17.8% increase in the Lambton Ward (when compared to the average of the last 9 Saturdays).

There are many assumptions why that were so. One of which was “it’s because we lost in Wellington so people went out drinking”. Did they?

To test this, we would look at New Zealand cardholder spending over the Late Night in the city centre. Assuming here that every Kiwi cardholder is an All Black supporter, of course.

And yes, New Zealanders spent up large in Wellington after the game! Late Night (10pm to 6am) spending went up 33.2%.

In Auckland, the All Blacks won and New Zealanders spent -15.5% less over Late Night!

There may be some truth to that assumption afterall!

Another assumption was that “Auckland has a higher population base, and most would have headed home”. In another words, there was a higher proportion of visitor spend in Wellington which contributed to their higher impact on spend. Is there?

Turns out, Wellington had 2.4% more visitor spend than Auckland.

To that effect, visitors to Auckland spent 80.2% more over Late Night, and visitors to Wellington spent a bit more, up +98.6% from the last 9-week average.

Again, there may just be some truth to this assumption too.

Other Mullings

Pre-game socialisation is actually where the magic lies for F&B operators. Spend on hospitality in that Late Afternoon, 2pm to 6pm time period, was up highest on match day, with everyone spending a combined 82.5% more in Wellington, and 44.0% in Auckland.

In fact, on match day, spend was up across the day except dinner. Presumably everyone is wont to watch the game and so spend over the Dinner time period (6pm to 10pm) was down -6.0% in Wellington, and down -23.7% in Auckland.